The 2-Minute Rule for Transaction Advisory Services

Table of ContentsThe Main Principles Of Transaction Advisory Services A Biased View of Transaction Advisory ServicesTransaction Advisory Services for DummiesNot known Factual Statements About Transaction Advisory Services Unknown Facts About Transaction Advisory Services

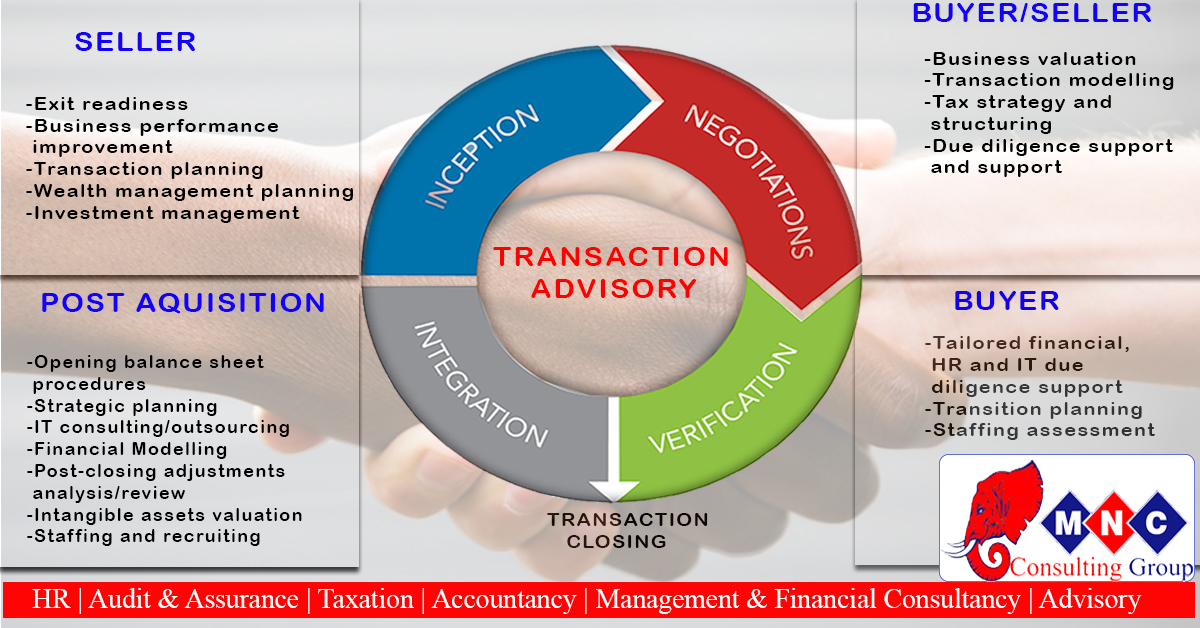

This action makes sure the business looks its best to potential purchasers. Obtaining the company's value right is essential for a successful sale. Advisors make use of different methods, like affordable cash circulation (DCF) evaluation, comparing with comparable companies, and recent deals, to determine the reasonable market value. This assists set a reasonable rate and discuss successfully with future customers.Transaction consultants action in to assist by obtaining all the needed info arranged, responding to inquiries from buyers, and setting up visits to the organization's area. Purchase consultants utilize their knowledge to aid service proprietors manage challenging arrangements, satisfy purchaser expectations, and structure deals that match the owner's goals.

Satisfying legal regulations is critical in any organization sale. They aid service proprietors in preparing for their next actions, whether it's retired life, beginning a new endeavor, or managing their newly found wide range.

Purchase consultants bring a wide range of experience and understanding, ensuring that every element of the sale is managed properly. With critical prep work, assessment, and negotiation, TAS helps company proprietors accomplish the highest feasible sale price. By ensuring legal and regulative compliance and managing due diligence along with various other offer employee, transaction consultants decrease possible threats and liabilities.

About Transaction Advisory Services

By contrast, Large 4 TS teams: Job on (e.g., when a prospective customer is conducting due diligence, or when a bargain is closing and the buyer needs to incorporate the company and re-value the vendor's Balance Sheet). Are with fees that are not connected to the bargain shutting efficiently. Make costs per involvement somewhere in the, which is much less than what investment banks gain even on "little deals" (but the collection probability is additionally much higher).

The interview inquiries are extremely similar to investment financial interview concerns, however they'll focus more on accountancy and appraisal and much less on subjects like LBO modeling. Expect questions concerning what the Change in Working Funding ways, EBIT vs. EBITDA vs. Earnings, and "accountant only" topics like test equilibriums and how to go through occasions utilizing debits and credit reports instead of monetary declaration adjustments.

The 10-Minute Rule for Transaction Advisory Services

Specialists in the TS/ FDD groups may additionally talk to administration concerning whatever above, and they'll create a thorough report with their findings at the end of the process.

The power structure in Transaction Solutions varies a little bit from the ones in investment banking and private equity careers, and the basic form resembles this: The entry-level function, where you do a great deal of data and financial analysis (2 years for a promo from here). The next level up; similar work, but you obtain the more interesting bits (3 years for a promotion).

In specific, it's challenging to obtain promoted beyond the Manager degree because couple of individuals leave the task at that stage, and you require to start revealing evidence of your capability to create income to breakthrough. look at here now Let's begin with the hours and way of life considering that those are much easier to define:. There are occasional late evenings and weekend break work, but absolutely nothing like the frenzied nature of investment banking.

There are cost-of-living adjustments, so expect lower settlement if you're in a cheaper location outside major financial (Transaction Advisory Services). For all positions other than Companion, the base pay comprises the bulk of the total settlement; the year-end benefit could be a max of 30% of your base pay. Frequently, the ideal means to increase your profits is to switch to a different firm and bargain for a higher salary and bonus offer

The Of Transaction Advisory Services

At this stage, you ought to just stay and make a run for a Partner-level role. If you want to leave, possibly relocate to a client and do their valuations and due diligence in-house.

The major problem is that since: You generally need to join an additional Large 4 team, such as audit, and job there for a couple of years and then relocate into TS, job there for a couple of years and after that relocate right into IB. And there's still no guarantee visite site of winning this IB role since it relies on your region, customers, and the hiring market at the time.

Longer-term, there is additionally some risk of and since evaluating a firm's historical financial info is not precisely rocket scientific research. Yes, humans will always require to be entailed, but with even more advanced modern technology, reduced head counts could potentially sustain client interactions. That said, the Purchase Services group beats audit in regards to pay, work, and departure possibilities.

If you liked this article, you could be curious about analysis.

The Buzz on Transaction Advisory Services

Establish innovative monetary frameworks that aid in determining the real market worth of a firm. Provide consultatory work in connection to service valuation to help in bargaining and prices structures. Clarify one of the most ideal form of the deal and the type of factor to consider to employ (cash money, supply, gain out, and others).

Do combination planning to determine the procedure, system, and business modifications that may be called for after the offer. Set guidelines for integrating divisions, innovations, and company procedures.

Recognize potential decreases by minimizing DPO, DIO, and DSO. Examine the possible client base, industry verticals, and sales cycle. Take into consideration the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence offers important insights into the functioning of the firm to be acquired worrying threat evaluation and worth production. Recognize temporary alterations to financial resources, banks, and systems.